Bonus tax rate calculator

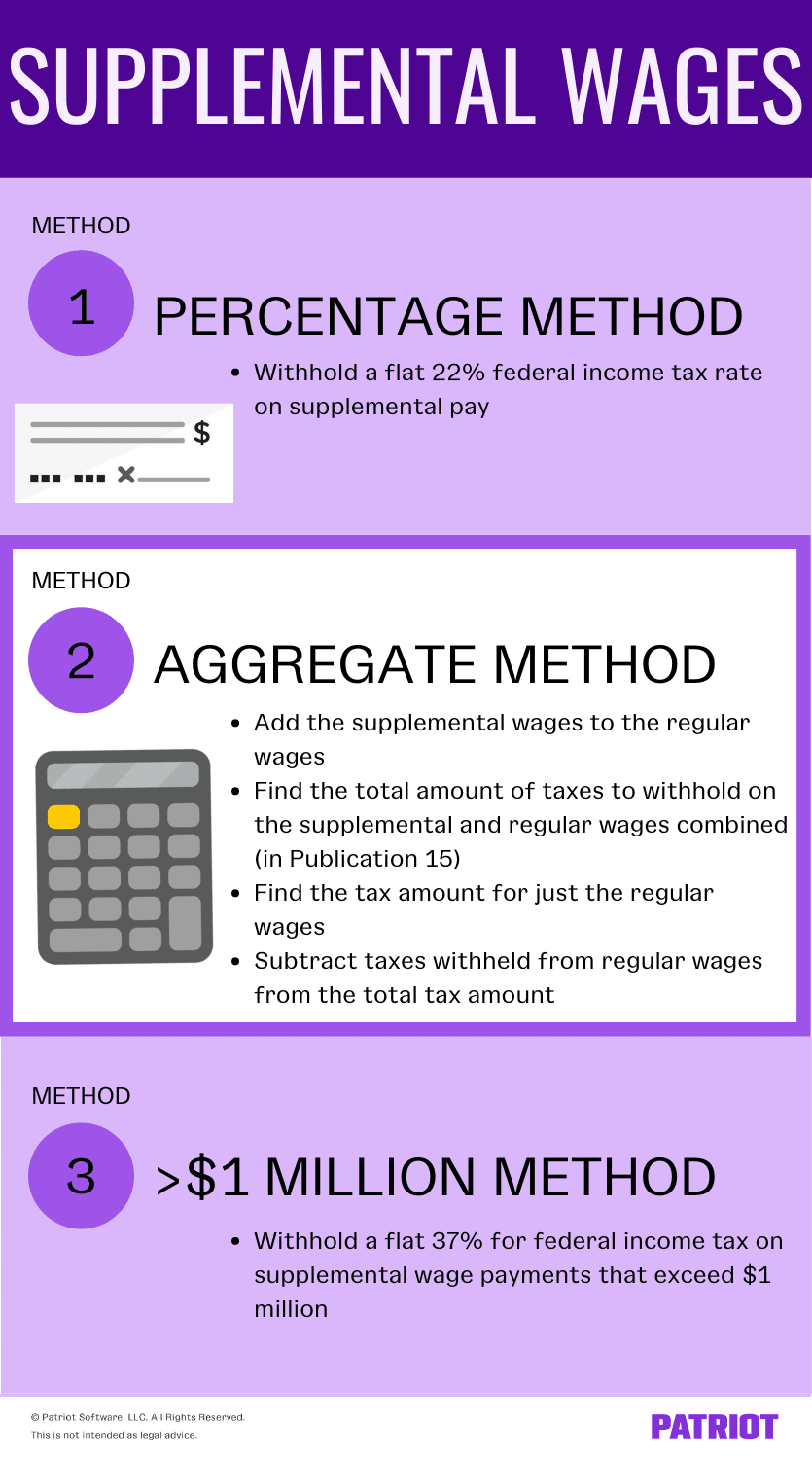

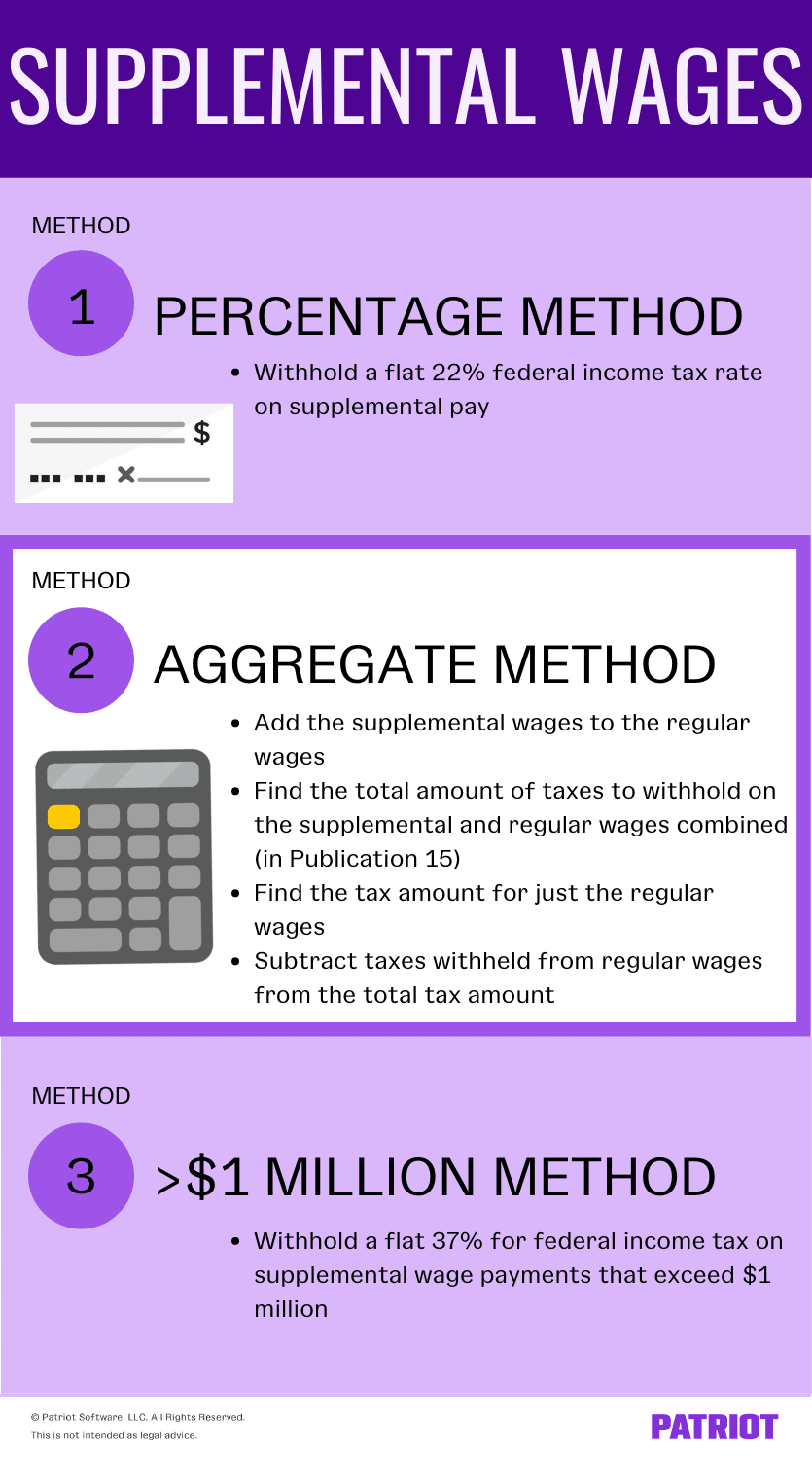

Under tax reform the federal tax rate for withholding on a bonus was lowered to 22 down from the federal income tax rate of 25. In many cases the IRS will use the percentage method because your employer will pay your bonus separate from your regular pay.

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

Anything above 1 million however is subject to withholding at 37.

. If you use flat withholding for bonuses you will simply apply a tax rate of 22 and pay the bonus by separate check. This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. The next half million will.

Thandis total tax for March 2020 will then be. Usual tax tax on bonus amount. With this tax method the IRS taxes your.

BTR B 22 Where BTR is. R258083 R260000. If your employee makes more than 1 million in bonuses annually different.

The California bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. The Florida bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Commission Calculator Bonus Tax Rate Formula The following two example problems outline the steps and information needed to calculate the Bonus Tax Rate.

If your state does not have a special supplemental. Bonuses over 1 million are taxed differently Your bonus amount below 1 million must have 22 withheld. The New York bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

This means that more of your bonus will be withheld but. This calculator uses the. YEAR GROSS SALARY NET BONUS Province Net Bonus Federal Tax deductions Provincial Tax deductions.

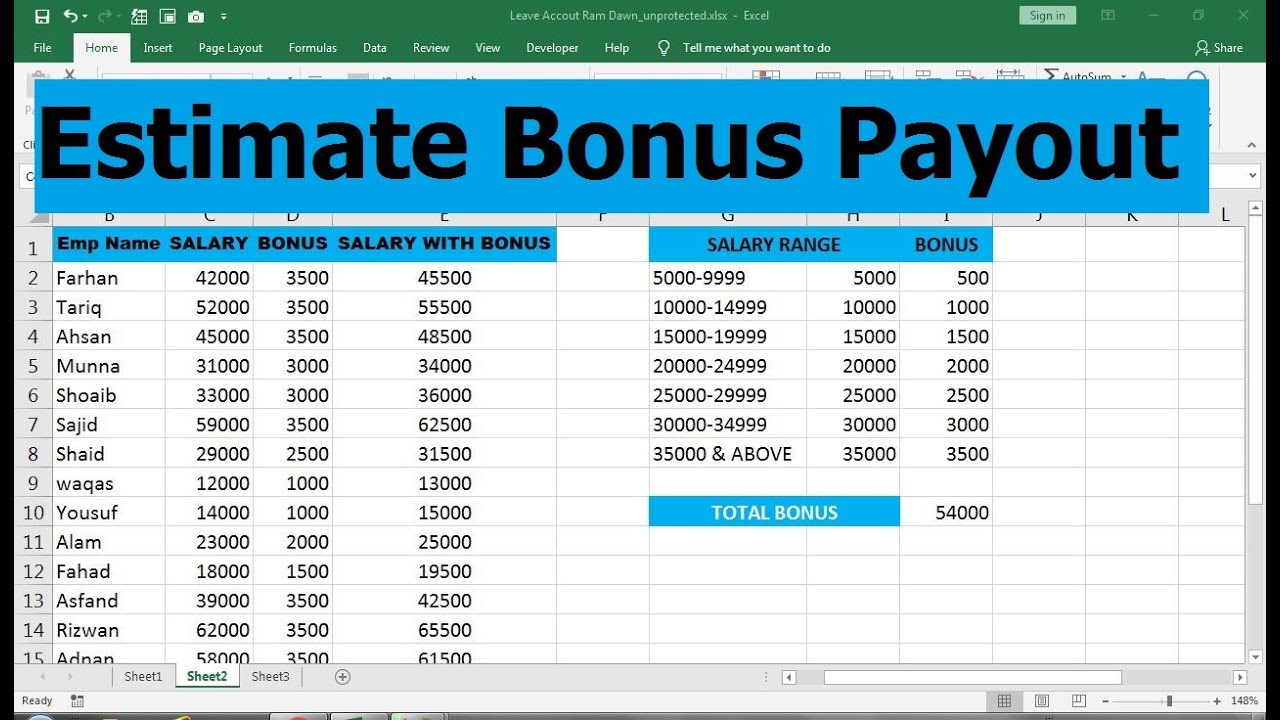

The calculator assumes the bonus is a one-off amount within the tax year you select. To calculate tax on a bonus you first need to determine which income tax brackets the employee falls under. Bonus for increase in the rating of the employee Bonus paid for incentive schemes offered by the employer If you earn a bonus for any of these reasons the bonus would be.

The Georgia bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Avantis easy-to-use bonus calculator will determine the right pre-tax amount. Youll notice this method gives a lower tax amount ie.

According to Revenue Canada these are Canadas federal income tax rates for. The Viventium Bonus Calculator uses your last paycheck amount to apply the correct withholding rates to special wage payments such as bonuses. The wording in the bonus calculator.

On the other hand if you fall into a lower federal tax bracket your bonus may be taxed at a higher rate than your regular income. The Texas bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. The first million will be subject to that same 22 tax making the withholding 220000 taking it to 780000 after taxes.

If you have other deductions such as student loans you can set those by using the more. And you decide to pay her a 1500000 bonus.

Bonus Calculation Excel Sheet Youtube

How To Calculate Bonuses For Employees

Llc Tax Calculator Definitive Small Business Tax Estimator

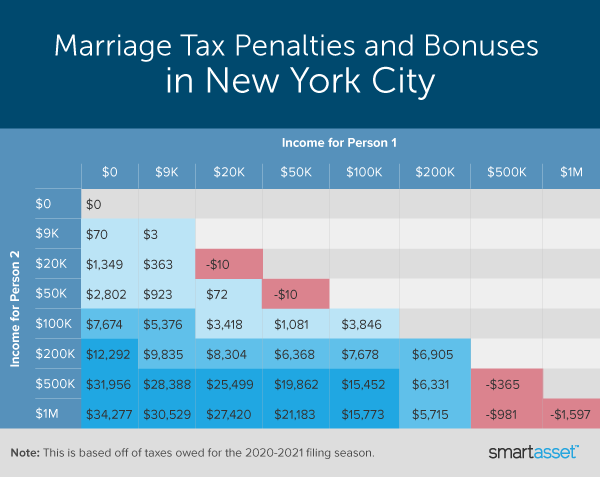

Marriage Penalty Vs Marriage Bonus How Taxes Work

How Are Bonuses Taxed With Bonus Calculator Minafi

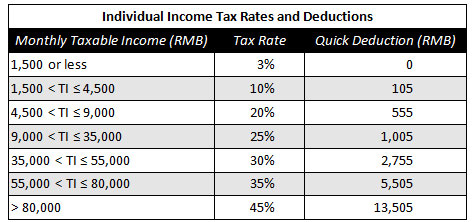

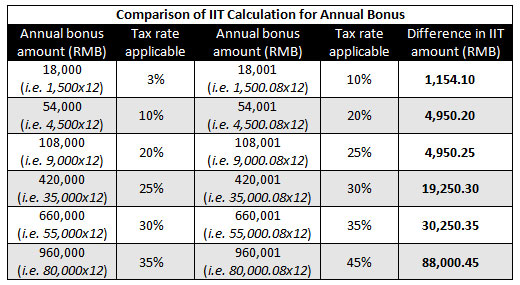

Calculating Individual Income Tax On Annual Bonus In China China Briefing News

What Is The Bonus Tax Rate For 2022 Hourly Inc

Avanti Bonus Calculator

Bonus Tax Calculator Online 55 Off Www Ingeniovirtual Com

Are Bonuses Taxed At A Higher Rate Bonus Tax Rate Methods

Tax On Bonus Calculator Clearance 54 Off Www Cernebrasil Com

Flat Bonus Pay Calculator Flat Tax Rates Onpay

How Bonuses Are Taxed Calculator The Turbotax Blog

Bonus Calculator Percentage Method Primepay

Calculate Bonus In Excel Using If Function Youtube

How Bonuses Are Taxed Calculator The Turbotax Blog

China Annual One Off Bonus What Is The Income Tax Policy Change