Trs pension calculator

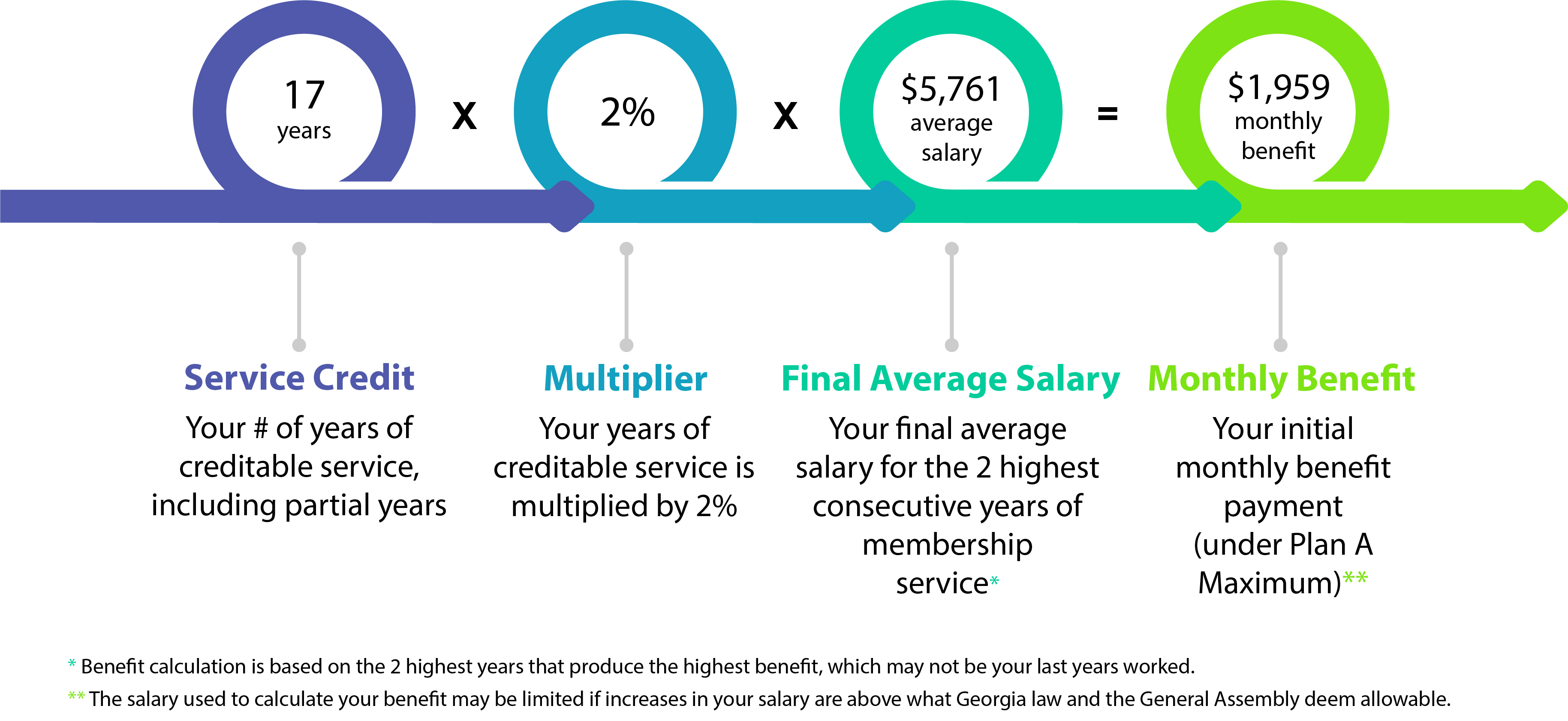

Pension Factor x Age Factor if applicable x Final Average Salary Maximum Annual Pension. You may use this calculator far in advance of your retirement to help you develop your personal retirement strategy by experimenting with various retirement scenarios.

Trs Texas On Twitter Need Additional Retirement Estimates Visit The Mytrs Retirement Calculator To Instantly Receive Retirement Estimates With Your Information Already On File Https T Co Uipqenwnxe Https T Co R7p91olqq4 Twitter

My TRS Log In.

. House Bill HB 385 HB 385 Explained for Retirees Employers. Receipt of COLA is not automatic. Tier 1 members in Teachers Retirement System of the State of Illinois first contributed to TRS before Jan.

All disabled members receiving PERS or TRS disability benefits regardless of age or date of hire. Register a property for Local Property Tax LPT Access the Local Property Tax LPT online calculator. Nearing retirementThere is an IRS withholding calculator available through your online account.

Account access at your fingertips - view information about your MassMutual insurance annuities pension annuities and investment accounts - view bills schedule payments update your address download 1099s and more. TRS Former Member Election of Participation DB or DCR Plan trs037 TRS Guidelines to Apply for Retirement brochure trs027 TRS Leaving State Employment brochure trs012. Public Information Requests pdf Social Media Participant Guidelines.

You and your employer contribute a percentage of income to fund the plan. To use the calculators on this page you will need to log in to MyTRS. TRS Plan 2 is a lifetime retirement pension plan available to public employees in Washington.

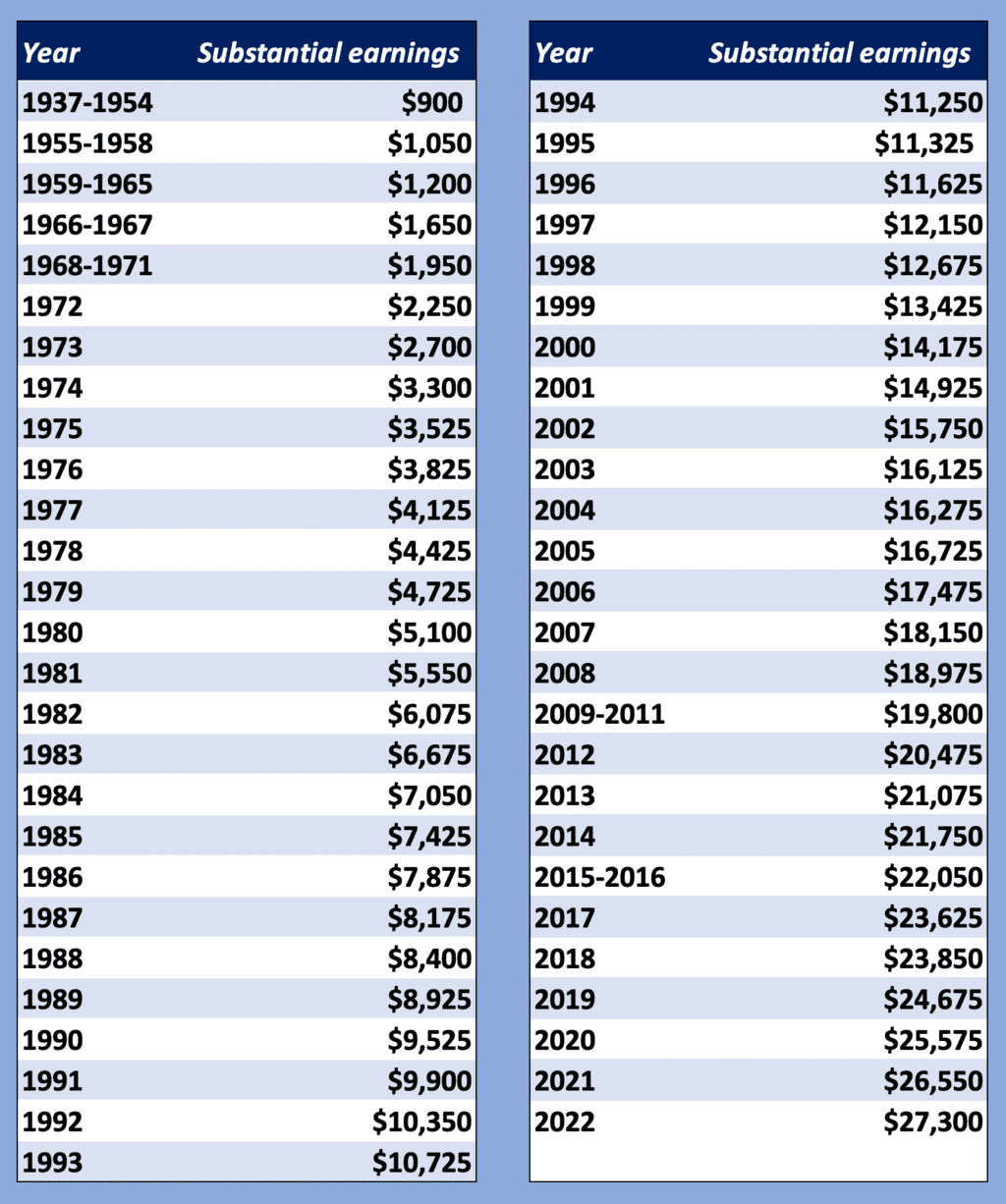

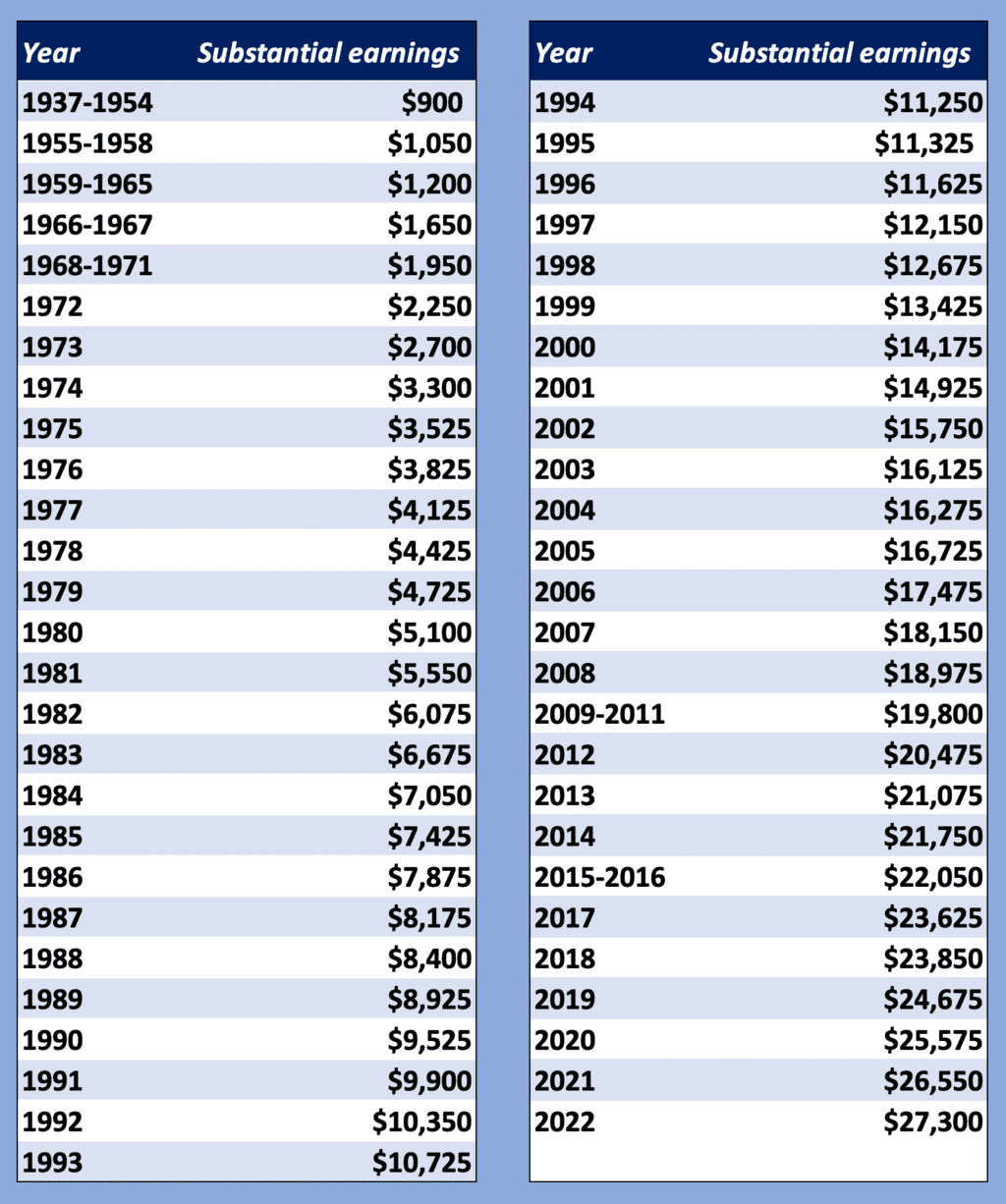

Based on your retirement date you may qualify for a first-year COLA adjustment. The amount of Social Security benefit you can expect after the WEP reduction for comparison we also illustrate your benefit without considering the WEP. Thus she is eligible for Social Security.

Access to stamp certificates. Your pension factor equals the sum of. Youll need to access your Annual Benefit Statement to use the calculator.

Members who first entered the TRS after June 30 1990 but before July 1 2006 and their survivors if they are at least age 65. But she also worked in the corporate sector before becoming an educator and earned 40 credits. I have a TRS pension based on 20 years of being a TX teacher.

Please arrive at least 15. Log in to your TRS Account today. 800am to 500pm Monday through Friday.

One thing that is important to note is that WEP cannot completely eliminate your Social Security benefit but it can reduce it to a very small amount. You can find the calculator for this here. Your Annual Statement of Account.

If you are eligible for Social Security. Pension Factor Tiers 1 and 2. TRS offers members a Tax-Deferred Annuity Program to supplement their benefits under the Qualified Pension Plan.

Will she receive it. Early retirement Calculator Excel106KB. Get started with a calculator below plus receive additional news and resources when you sign up for our newsletter.

Upon retirement she will receive her TRS pension. If you didnt pay Social Security taxes on your government earnings and you are eligible for Social Security benefits the formula used to figure your benefit amount may be reduced. The Washington Retirement System managed by the Department of Retirement Systems DRS is a somewhat sprawling collection of retirement plans.

Pension Fund Facts at a Glance. Advance Planning for Retirees. The programs we offer are listed below.

PERS and TRS Plan 1 COLA. The early retirement calculator shows what to expect if you claim benefits earlier than normal pension age. TRS is one of the largest pension systems in the United States serving 200000 members.

Some federal employees and employees of state or local government agencies may be eligible for a pension based on earnings not covered by Social Security. Have you updated your beneficiaries. A 18 per year of credit for NYS service before 1959 and b 2 per year for NYS service after 1959 and c if eligible 1 per year for prior out-of-state service as long as this.

You can modify your marital status the number of exemptions and other deductions to estimate changes in your withholding. See our schedule for whats available soon. The amount that she can collect is determined by this calculator.

My TRS Log In. Investment Joint Management Committee Meetings. 1 2011 or have pre-existing creditable service with a reciprocal pension system prior to Jan.

Withholding Calculator inside MyTRS After you log in and select to use this withholding calculator it will display your current annuity and withholding elections. Access the Local Property Tax LPT online valuation guide. Of the 20 years only 40 months were not covered by SS.

While all systems are primarily defined benefit plans many plans introduced a defined contribution portion for members hired more recently in order to supplement what the employers and pension fund will have to. This calculator uses only information provided by you and does not use any information contained in the records of the Retirement System. This calculator will tell you.

Retiree Beneficiary. It takes into consideration the amount of your pension and then. New TRS Podcast Episode.

1000 Red River Street Austin TX 78701-2698 800 223-8778 wwwtrstexasgov Teacher Retirement System of Texas Page 1 of 1 Request for Estimate of Retirement. This program designed just for TRS retirees reviews timely topics such as beneficiary designations Required Minimum Distributions and online access to TRS accounts. Home Contact Us.

This pension calculator is provided solely as a tool for an individual member to obtain an unofficial estimate of their retirement benefits. The Social Security calculator will take into consideration the amount of your TRS pension and then decrease the amount of your Social Security by a factor. To estimate the cost use the Buy Back Calculator for Public Education Experience.

The calculator will not estimate 1995 Section benefits for members aged 50 to 55. Are you collecting your pension and planning to. Box 302150 Montgomery Alabama 36130-2150.

Members who first entered the TRS before July 1 1990 and their survivors. Office Visiting Hours 800am to 430pm Monday through Friday Please bring non-expired government issued picture identification with you drivers license passport Military ID etc. Street Address 201 South Union Street Montgomery Alabama 36104 Mailing Address P.

TRS Defined Contribution Retirement Plan Features and Highlights Employer Toolkit TRS ElectionWaiver of Supplemental Contributions trs019 TRS Employer Manual. Since 1917 TRS has been building better tomorrows for New York City educators. If you do not have an online account DRS has another withholding calculator available to you.

The TRS pension calculator is an educational tool designed to help members who are more than 5 years from retirement estimate their monthly benefit for service retirement. Apply for tax relief at source TRS on mortgage interest. Investing for Retirement and How to Avoid Fraud.

Once you are eligible you will receive any COLA starting with the pension check mailed out at the end of April and every year after. You might want to speak with your tax advisor or the IRS if you have questions about your tax withholding. Retirement Estimates TRS Retirement Estimate Calculator.

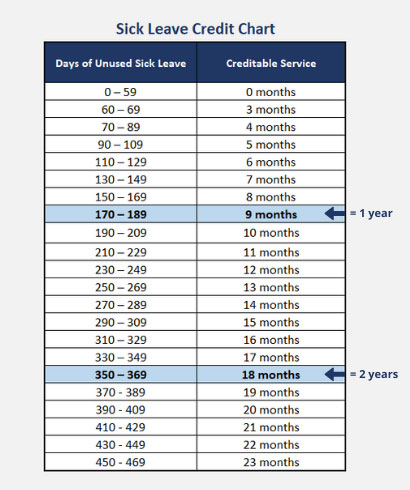

LEOFF Plan 1 Base COLA does not have a maximum and does not include COLA Banking. Private School Service Credit If you previously worked in a recognized private school you may be eligible to purchase up to 2 years of service credit.

Teachers Retirement System Of Georgia Trsga

Teacher Retirement System Of Texas Trs Benefits Handbook December 2013 Page 30 The Portal To Texas History

How To Determine When To Retire From Teaching

Teachers Retirement System Of Georgia Trsga

Term Pay Calculator

Trs Care Drastic 2018 Changes Creates Opportunities For Texas Agents Empower Brokerage

Ny Teacher Pension Calculations Made Simple The Legend Group

Trs Contributions And Benefit Formula Quick Explanation Youtube

Overview Of Teacher Retirement System Of Texas Pdf Free Download

Teachers Retirement System

Estimate Your Benefits Arizona State Retirement System

Ny Teacher Pension Calculations Made Simple The Legend Group

Chaz S School Daze Two Simple Charts That Compare Tier Iv And Tier Vi Pension Plans

Teachers Retirement System Of Georgia Trsga

Shannon Jones New Retirement Benefit Specialist State Of Georgia Teachers Retirement System Of Georgia Linkedin

How Teacher Retirement System Pension And Social Security Benefits Work Together Nasdaq

Teacher S Retirement And Social Security Social Security Intelligence